Welcome & Introduction: Setting the Stage for Financing Maritime

Géraldine Andrieux: Welcome to this digital session about financing maritime innovation and infrastructure for climate and ocean. I wanted to also introduce our panelists, so we have a great chance to have with us today, Denis. We’re going to speak about financing climate resilience infrastructure and projects: What are the challenges and opportunities? Thank you again for joining us today, Denis, because you have a huge expertise in this field. We have already received a lot of questions that we will be able to address today. And Marine, who is with us also, will collect your questions. So, Denis, you are the founder of AltRaise. AltRaise is a private banking company, and you are especially active in climate investments, so this is your key focus right now, but you have also strong expertise coming from infrastructure financing, working at EBRD but also GE Capitals.

Denis Viennot: Thanks so much Geraldine and Marine. So, hi everyone, great to meet you. As mentioned, I’m the co-founder here at AltRaise, we’re a corporate finance boutique, called Investment Bank, based in Paris and London, which I co-created about eight years ago now. With, really, in our DNA and sole focus to advise companies and projects, both in OECD markets and in emerging markets, and particularly Africa, that have a sustainable development angle, energy transition, climate change, you know, in the broader sense. So, we advise companies from startups to project developers on raising capital, whether equity and debt, as well as on M &A, merger and acquisition operations. Within AltRaise, we’ve had the chance to work across the spectrum from companies with innovative technologies, which are, of course, very relevant to the discussion today, and how to apply them to cities in general, but in particular, port cities – all the way to renewable energy infrastructure projects, and obviously, over the last couple of years, a lot of discussions with developers or sponsors – and these include cities – of hydrogen or e-fuel projects, which, as we know, are particularly important for port areas. Just briefly, before AltRaise, I indeed spent a number of years at GE Capital, General Electric Capital, looking at diverse types of financing, including waste to energy, clean infrastructure projects such as wastewater treatment facilities or water treatment facilities, as well as renewable energy projects. And then went on to spend four years at the EBRD in their climate change team. Most of you know the EBRD, but it is a development finance institution. It works both with governments and authorities and with the private sector, with a specificity versus other DFIs that are very focused on the private sector. And so, it really is a vector of promotion of the private sector and of private sector finance, which is relevant for our discussion today.

Géraldine Andrieux: Thank you, Denis. And indeed, today is the first of a series of webinars that we are preparing to meet all together on the 6th of June, and we’ll come back on that with Marine later. But the goal of today is really to make an introduction to what is needed, what could be the opportunity for Port City to get access to private financing, so we’ll come back on that.

I wanted also to highlight that BLUMORPHO is very happy to collaborate with two major partners. So BLUMORPHO, the company I created myself about 10 years ago, is especially dedicated to give the best condition to adopt innovation. And along with that, obviously, financing is key. We have already been able to support companies to raise 1 billion euros. But it’s not only about innovation. It’s also about ecosystems and networks. We are very happy to collaborate with AIVP, the leading international association of port cities that gathers more than 200 members. It’s a great network, and we are also a member of this fantastic association with a great team. We are very happy to collaborate with them. And also, with the Fondation Prince Albert II of Monaco, very dedicated to climate resilience and to support the ocean and to obviously protect the ocean. So, all three of us are very looking forward to collaborating with you to support the transition of urban port ecosystems. And I want to explain why actually urban port ecosystems are so important to us. Because as you can see, we are focusing on the maritime industry.

- Urban-Port Ecosystems: The Key to Maritime Decarbonization

Géraldine Andrieux: As you can see, we are focusing on the maritime industry. But when you look at the maritime industry, it’s facing a huge challenge, which is its decarbonization. Decarbonization is obviously a regulation constraint, as we know that by 2050, the shipping industry has to reach net zero. But the thing is that we don’t yet have the right solution in terms of energy sources. It’s very difficult to get renewable energy competitive compared to fossil fuels.

We have done already last year a big action with Marine on Financing Maritime Innovation and we realized that just 0.1 percent of ships are using renewable energy for the moment, so a big challenge.

Why Financing Green Urban Infrastructure Is Urgent: Key Figures

Denis Viennot: First of all, cities in general are a key player in the transition to sustainable infrastructure and resilient systems, as well as improved environmental justice, for citizens. You know, cities in the broader sense, represent most of the world’s population, most of the world’s GDP, and most of the world’s greenhouse gas emissions. And of course, the majority of cities are coastal cities. And within these port cities are critical.

A lot of the world population is living in port cities, probably around 50% of the world’s population, but also port cities are critical because of their nature of their activity at the center and at the crossroads of the global transport system, of the global trade system, which is becoming even more important these days with US volatility right now on trade. These cities not only can have a major impact on maritime transport, but also local transport, hydrogen transport corridors, for example, that are being rolled out in Europe, imports of e-fuels, hydrogen, as well as, everything that can be done locally to cut greenhouse gas emissions, reduce pollution, and develop green infrastructure, whether local transport or electricity supply, etc.

Géraldine Andrieux: So according to you, interesting markets for investors. We have Port Cities with us today, but we have also a lot of innovative companies. We want also to see how they could collaborate with Port Cities and what could be the opportunities of financing. So, we can come back on that later on. But what financial tools can be available for cities to get access to financing right now?

From Public Funds to Innovative Tools: The Full Spectrum of Green Financing Options for Cities

Denis Viennot: There’s a wide range of tools, both on the financing side, which we’ll focus on today, but also on the funding side, which is slightly different, and we’ll come back on this. But what is interesting is that while there is a huge need for financing from port cities and cities in general, there’s also a huge gap in finance. And in particular two categories. One across the globe for the transition to green infrastructure and resilient infrastructure, there’s a lot of publications around that huge financing gap in trillions right over the next decade. And two for cities which are less wealthy and have less funding than very large cities which have more capacity and a deeper economy to rely on. Within these two categories, there’s a huge funding need and the private sector but also the public sector when it innovates has a huge role to play. A couple of KPIs that we share on the slide which are that, you know, many, many cities are constrained. But for different reasons: either they lack public funding, or national governments hinder them and stop them from borrowing, for example, or because they are not wealthy. So that leaves a real need for a very proactive approach from cities to expand the part of funding, financing, and funding that they can access, as well as interest for innovative sources of financing.

Géraldine Andrieux: Which is good news because what we are especially focusing on is this, you know,

developing innovative approaches that will fit also with the interests of all cities, but also financial players. Taking that into account, if you have some advice to give to Port Cities, and I think that a lot of them are looking for that, what will be your key advice today?

Denis Viennot: I think it’s important to understand that obviously there are different sources of financing. The traditional ones – loans from governments, grants, tax, of course, etc. That’s more a funding source, but you have public sector options which are usually well-known, but not always, and some of them are in the innovation categories, but should have access to different types of public funding, including the public funding from international institutions, particular for cities in, let’s say less wealthy areas, but not only. There are international institutions focusing on each and every country, whether it’s developed or not developed. And then, of course, you have the private sector, which we’re going to today. And in between private sector and public sector funding options, you have what we call blended finance, which allows to mix the two and has many benefits. And then across these different types of financing sources, you have innovative approaches. So, for example, innovative approaches with DFIs can include green funds, like the Global Environment Facility, the Green Climate Fund, I’m sure you all know of. There are many: carbon mechanisms, which have been very volatile and not extremely successful up to now. Nevertheless, there are examples of successful carbon finance mechanisms, in particular on the voluntary markets. And in the private sector, you also have a lot of innovative finance in the sense that many private sector investors are investing in green bonds, for example.

Attracting Private Capital to Urban Green Projects: Strategies That Work

Géraldine Andrieux: To address how port cities can attract private investors—bearing in mind that each port city is unique and context-specific—this is a key question we should focus on before opening the floor to questions.

Denis Viennot: Each initiative or project must have its own business model. You can go to private investors with a PPP, including concessions and other forms. You can raise finance, then rent infrastructure to private players. There are many configurations. What’s critical is that cities prepare. If the question is how to attract private investment, the first step is to create the right market. Private investors usually won’t look at projects below a certain size. They want a clear framework and conditions, which cities need to think through before reaching out. Cities must also be prepared internally, with expertise, knowledge, and staffing. These are complex projects. For example, if a city wants to finance shore power supply, and other cities in the country have similar goals, it might make sense to pool projects into a larger framework to reach scale. Then you can approach private investors. The second point is obvious: private investors will only be interested if they expect a sufficient return on investment and if perceived risk is limited. There are many ways to support this. When projects are commercially viable, it’s about setting the right conditions, ensuring the concession agreement is long enough, for example, for the project to repay debt and equity. When projects are not commercially viable, often the case for resilience or community-enhancing projects, and sometimes for green infrastructure, you must think about boosting returns and limiting risk. This could involve new taxes, grants, blended finance, or guarantees (from national governments, DFIs, or even the private sector). So the short answer is: cities need to create the right environment well in advance of approaching the private sector.

Géraldine Andrieux: You mentioned risk limitation. Do you have examples? And what about avoiding unproven models of technology? That’s important, because many innovations aim to improve productivity and show impact. How do we deal with that?

Denis Viennot: Risk limitation can take many forms. It can involve clear, transparent management of project revenues and expenses. It can involve proper reporting and guarantees, national or partial guarantees, or those from development finance institutions or donors. The way contracts are drafted also matters. For example, if an operator brings a green project using an unproven model, say, energy efficiency in buildings, there needs to be security for the investor. This could be partial guarantees from the city or state, legal provisions, or floor payments to the private operator. As for technology: tech is critical across city financing and project management. It helps improve efficiency. But what I mean here is that cities shouldn’t ask private investors to fund projects using unproven technologies and models while taking on all the risk. Before asking private investors to fund or scale a new tech, cities should finance at-scale demonstration projects or offer guarantees. For example: if you want private players to roll out hydrogen, and it fails, then you need to guarantee backstop mechanisms, ensuring at least a minimum return, say 10%.

Géraldine Andrieux: That’s interesting, especially as more port cities collaborate with innovative companies, create incubators, and demonstrate the value of new technologies.

Port cities are interesting ecosystems. Once collaborations start and results are in, the risk linked to innovation adoption is reduced.

That’s why port cities are so promising. If I had to highlight one challenge, it would be return on investment.

Understanding Financing vs. Funding: Building the Financial Foundation for Resilience

Géraldine Andrieux: When we spoke, you said something I liked: the difference between financing and funding. Could you explain that to our participants?

Denis Viennot: Very briefly: Financing is how you obtain the money to build the asset. Funding is how you pay that financing back, how you repay the capex. Cities have many options here, often very innovative. Even if you ask private investors to finance and operate a project that isn’t commercially viable, like low-income housing or environmental projects, you can still offer them acceptable returns through creative funding solutions. These sources can include national government subsidies. But cities can also create new taxes, use land value capture (like land pooling or rezoning), or create revolving funds (like customers repaying connection costs for electricity). So even for projects that aren’t immediately financially sustainable, you can find alternative ways to fund them. This often answers a key concern from cities: how to achieve green projects without making them unaffordable.

Géraldine Andrieux: It’s perfect, so you answered the question. We have a question from Rosemary asking if you could give a bit of example, and if you have some best practice or financing port-based business or port planning expansion. Maybe we can take the example of part of San Diego, because I think it might be interesting also to consider it as a good practice as well, that we can get inspired.

Denis Viennot: Yes let’s go to San Diego. This is just one case study among many. There are many more available publicly, including on the AIVP website. AIVP also shares interviews with ports on good practices. San Diego is interesting because it’s one of the first ports that really started engaging in decarbonization. It received substantial support from the U.S. government — through tax breaks, subsidies, and clear policy guidance. In this case, national support really helped, although it’s not always there. San Diego is a strong case because it followed the typical steps of a good decarbonization strategy for a port. We’ve broken it down into five elements. First, the strategy development and preparation. San Diego tied decarbonization to community co-benefits from the outset. This included addressing noise, air pollution, clean infrastructure, and connectivity, especially for neighboring, often underserved, communities. The port also conducted an inventory of pollution, emissions, and inefficiencies. This is an area where technology plays a key role. Various existing technologies can be used to measure, track, and monitor emissions. Ports should undertake this step early. The second step is port development and planning. Decarbonization actions were integrated into port development through updated planning processes. This included: New construction norms and materials; Retrofitting of existing buildings; Land-use strategies that prioritize green and decarbonized activities; Energy demand. San Diego set clear targets, such as transitioning to 100% zero-emission cargo trucks by 2030. To achieve this, the port created a framework and incentives (subsidies) to support operators in adopting clean technologies. However, ports cannot act alone. Private players also need to see economic benefits under the right conditions. Step four is energy supply: the port invested in decarbonized shore power infrastructure for ships and engaged with port users to adopt it. In this case, utility company S.C. Edison provided electricity and managed billing, while the port itself funded the infrastructure and created the regulatory framework. And finally, financing mechanisms. San Diego leveraged a combination of its own funding (port fees) and public/government funding for planning and infrastructure.

Financing Maritime Innovation: Process, Key Topics & June 6th Co-Creation Day

Marine Hamelin: Thank you for joining us today for this session. Just for a short reminder, we are working on this process for the months to come. So, for now, we’re in the first phase where we discuss with AIVP members to really highlight the key topics they want to work on and to find innovation, find solutions that will answer their needs. We are also mobilizing this ecosystem through digital sessions. We are in active look for solutions that will be the next generation of energy, of biodiversity protection of everything that can be relevant in the port city and maritime industry ecosystem to achieve its sustainable transition. So, if you have a solution, you can introduce it into our

application form, which you will find on the website of BLUMORPHO. And whether you are a city, an investor, a port, or a solution provider, we all invite you to join us for this co-construction day in Monaco on June 6th. That will be right before the

Blue Economy and Finance Forum, which is held by our partners, the Foundation Prince Albert II, which is in the context of UNOC. And of course, we will keep on building on this momentum for the next few months, especially until the AIVP conference in November. To get involved, you can write us at

blueeconomy@blumorpho.com Just to share a little bit more about the gathering in Monaco.: we will have a day which is dedicated to discussion. In the morning we will have two keynotes and panels where we will have discussion to kick off the day, and the rest of the day we will have one-to-one meetings, some exclusive workshops to highlight cases just like we are doing right now, and it will be the opportunity to go in more detail because we will be working on these concrete cases we are building at the moment. We will welcome you in the Monaco Yacht Club, and you will of course be invited to participate in the Blue Economy and Finance Forum.

Géraldine Andrieux: So right now we’re just giving you a bit of inspiration for what could be the relevant financial model, but we want to be very innovative, and to cover different topics that are very interesting in the green financing. We will also be working on post fossil fuel ecosystems, which is a very important point as we started discussing with Denis before. Green Infrastructures will be adressed. We are also very interested in ship breaking and refitting. It is an important part of the decarbonization of the shipping industry, and is definitely a strong focus. Two other aspects that are important to us are biodiversity protection, and also, how to leverage data to make these financial mechanisms even more attractive when it’s dealing with sustainable finance. And just for you to know, we have a lot of discussion with different institutions that will join on the 6th of June.

Q&A: What exactly is a bond? What’s the difference between a bond and a loan?

Géraldine Andrieux: Denis, if you’re okay, we can jump into the questions. We had already collected some beforehand, and we’ve also received an additional one. Let’s start with the first: what exactly is a bond, and what’s the difference between a bond and a loan?

Denis Viennot: A bond is a debt instrument that allows you to raise funds from a much wider pool of investors than just banks. Banks typically offer loans, but bonds can be issued to investors across the world. This significantly expands the pool of capital you can access compared to a loan. There are other differences, but that’s the key one. Also, bonds are often public instruments and listed, which gives you, as an issuer, access to capital markets focused on public securities rather than private ones.

Géraldine Andrieux: That’s very interesting, especially as we’re seeing growth in sustainable bonds. It’s a growing trend we’ll come back to in the next webinar, which will focus specifically on sustainable finance. We’ll be joined by investors working in this area, particularly on sustainable finance and bonds, and they see port cities as very promising ecosystems. Today is just an introduction, open to all companies and port cities, not just AIVP members. But for the next steps, we’ll dive deeper with AIVP members and others joining the initiative.

Q&A: Focusing on a sustainability criteria for financial products, what are the associated challenges?

Géraldine Andrieux: That’s a great question we’ve received: is sustainable finance more focused on Europe, or is it a global trend? We know we have participants joining from the U.S. today as well. So Denis, what’s your view? Can green projects and sustainable finance apply equally in Europe and elsewhere?

Denis Viennot: It’s absolutely a global trend. Interestingly, China is currently the country that has invested the most in the transition to green infrastructure. That may seem counterintuitive given its industrial profile, but the investments are real and significant. You also see strong engagement in African cities, Cape Town being a good example, as well as in Latin America and across the U.S. So it’s not just a European movement; it’s happening worldwide. This isn’t just about following trends or guidelines: it’s about building the future of cities. It’s about public health, climate resilience, and even long-term economic performance. The upfront costs can be high and financing can be complex, but the long-term benefits, both social and economic, are substantial.

Géraldine Andrieux: We also had a question about the role of the European Commission. Some city-level projects already receive European support for innovation. Do you think that type of backing helps bring in more financial players?

Denis Viennot: Absolutely. The European Commission plays a critical role, and I know there are many experts here today who can speak to this. For example, there’s a €400–500 million program supporting port city transitions to green infrastructure and alternative fuels, through what’s known as the Alternative Fuels Infrastructure Facility. That’s just one example. Beyond that, institutions like the European Investment Fund (EIF) and the European Investment Bank (EIB) are heavily involved in funding these transitions. So yes, the European Commission’s support, from both an innovation and infrastructure financing perspective, is essential.

Géraldine Andrieux: Yes, and we’ll soon be discussing the EU’s Clean Industrial Deal too, which is also dedicated to supporting port cities. So, collaboration with the European Commission is clearly important, both in terms of innovation and infrastructure development.

Denis Viennot: Definitely. And beyond Europe, you also have institutions like the World Bank’s IBRD, the Global Environment Facility, and various UN entities offering significant support for port city transitions. Regional development banks, such as the Asian Development Bank, Inter-American Development Bank, and African Development Bank, are also very active and well-funded. They all play a critical role in helping port cities adapt and evolve.

Géraldine Andrieux: Exactly, and that’s one of the goals of this initiative. We’re building a network of financial players, both public and private, to support maritime innovation and infrastructure for climate and ocean action. If you’d like to receive more information on these efforts, please let us know, we can tailor it to your profile, whether you’re a port city, an innovative company, or another type of organization. And Denis, a final follow-up that keeps coming up: how would you distinguish between public and private financing for port cities? We’ve talked about blended finance, but do you think they bring different expectations?

Denis Viennot: Yes, absolutely. Public and private funding are fundamentally different. With private investors, you have to address their specific concerns, whether that’s through structuring the right concessions, managing risk levels, or ensuring adequate returns. But the important point is that public and private funding now work more closely together than ever. There are many bridges between the two, and when well-aligned, they create powerful opportunities for cities.

Géraldine Andrieux: Exactly. And as we’ve seen in discussions around sustainable finance, ESG can actually become a business opportunity for port cities. Some financial institutions are required to invest in ESG-compliant projects, and port cities, by their nature, can contribute to all three pillars: Environmental, Social, and Governance. So there’s real potential to explore that further.

Closing Remarks & Next Steps: From Inspiration to Action

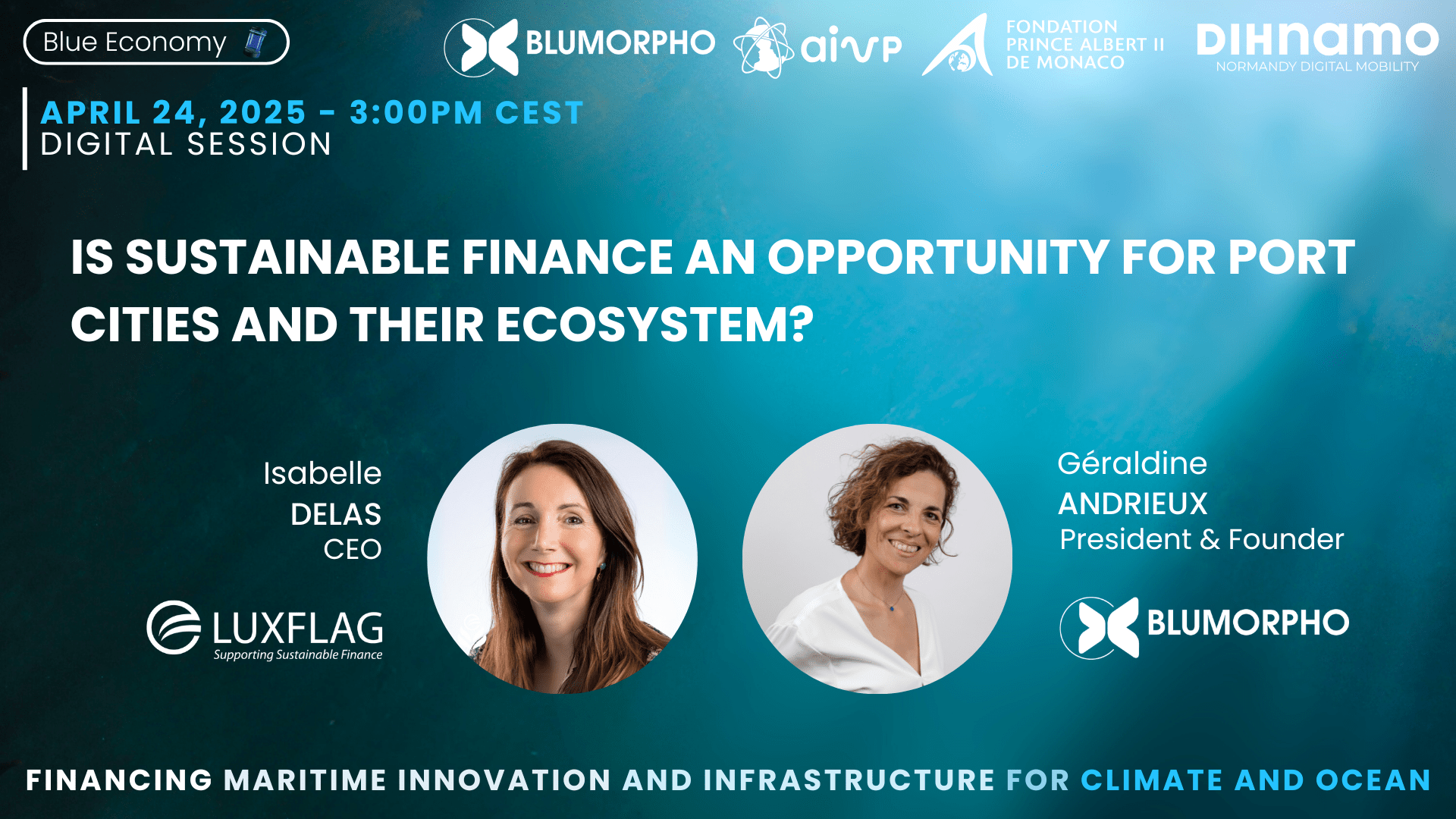

Géraldine Andrieux: So, I think we’re going to have to conclude now. Again, we are looking forward to seeing you all on April 24 with Isabelle Delas from LuxFLAG, where we’re going to also deep dive a bit more on sustainable finance. Thank you so much, Denis, for answering all our questions. I see that we have a lot more questions, but we will answer them separately in more detail. We will have the great pleasure to have you with us also on the 6th of June in Monaco to be part of this co-construction approach where we can bring your expertise not only supporting infrastructure and project but also innovative company to reach their target in financing and raising funds so that’s quite interesting. So, thank you very much Marine for organizing it and looking forward to seeing you all if you have any questions don’t hesitate to contact us. Thank you again Denis.

Start-up mode® for Corporate InnovationCorporates collaborate with us to generate and operate new value propositions and attractive business models.

Start-up mode® for Corporate InnovationCorporates collaborate with us to generate and operate new value propositions and attractive business models. Deal flow and Customers acquisitionFor Corporates and Entrepreneurs to activate high value collaboration and investment opportunities

Deal flow and Customers acquisitionFor Corporates and Entrepreneurs to activate high value collaboration and investment opportunities

Denis Viennot is a Founding Partner of AltRaise, an independent investment bank dedicated to climate change and sustainability challenges. Denis has over 20 years of experience in Corporate Finance, Project Finance, International Development Finance, and as an investor and entrepreneur at a global level. Denis was previously a Principal at the European Bank for Reconstruction & Development, where he was notably responsible for developing clean and renewable energy programs. He will share his expertise with our audience.

Denis Viennot is a Founding Partner of AltRaise, an independent investment bank dedicated to climate change and sustainability challenges. Denis has over 20 years of experience in Corporate Finance, Project Finance, International Development Finance, and as an investor and entrepreneur at a global level. Denis was previously a Principal at the European Bank for Reconstruction & Development, where he was notably responsible for developing clean and renewable energy programs. He will share his expertise with our audience. This digital session is organized as part of the collaboration between Blumorpho and AIVP in the initiative Financing Maritime Innovation and Infrastructure for Climate and Ocean, designed to accelerate the financing of the environmental transition in port cities by enabling them to leverage innovation and develop new services that generate recurring revenues to attract private investor.

This digital session is organized as part of the collaboration between Blumorpho and AIVP in the initiative Financing Maritime Innovation and Infrastructure for Climate and Ocean, designed to accelerate the financing of the environmental transition in port cities by enabling them to leverage innovation and develop new services that generate recurring revenues to attract private investor.

Isabelle Delas is CEO of LuxFLAG, the global labeling agency for sustainable finance. She brings a wealth of experience in financing, with a strong focus on sustainable finance and a deep understanding of both developed and developing markets. Working at the intersection of financial innovation and sustainability, she helps to guide investment flows toward impactful projects.

Isabelle Delas is CEO of LuxFLAG, the global labeling agency for sustainable finance. She brings a wealth of experience in financing, with a strong focus on sustainable finance and a deep understanding of both developed and developing markets. Working at the intersection of financial innovation and sustainability, she helps to guide investment flows toward impactful projects.